The Ministry of Finance successfully held the second auction in history for the exchange of government bonds.

The Ministry of Finance of Ukraine conducted another auction for the exchange of domestic government bonds. As a result of the auction, bids were submitted for a total amount of more than UAH 13.4 billion, and UAH 10 billion was satisfied. Investors were offered reserve bonds with a nominal yield of 15.01% per annum and a coupon payment of UAH 75.05 every six months, with a maturity term until 2028.

The weighted average yield as a result of the auction amounted to 15.45%, with a maximum yield of 15.60%. 19 out of 22 bids were satisfied.

For redemption and cancellation, bonds with a maturity date until 2025 in the quantity of 9,758,415 pieces will be credited to the Ministry of Finance's account.

The ministry emphasized that the successful conduct of the exchange auction allows for effective management of the state debt and ensures more efficient liquidity management.

Read also

- Ukrainians will begin mass checks from July 1: who will be affected and what threatens

- Car Repainting: Drivers Explained When Registration is Required

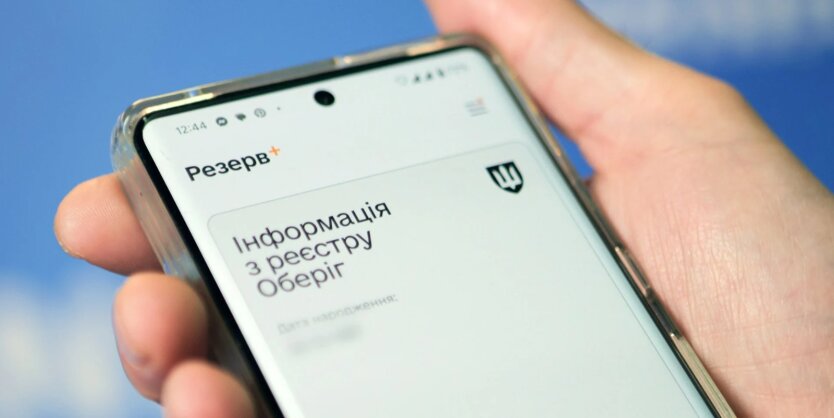

- Ukrainians will be able to sign a contract with the Armed Forces of Ukraine in 'Reserve+': when the function will be active

- Hackers are attacking the smartphones of Ukrainians: which apps and programs need to be urgently removed

- Ukraine will abandon 50 kopecks: what will replace the coin

- The heatwave up to +37 will change to icy downpours: the forecaster named the most dangerous days of the week